35+ Roth conversion tax calculator 2020

A Roth IRA conversion is a tool that allows individuals to convert money from a tax-deferred retirement account like a traditional IRA or 401k into a Roth IRA. Usually the vendor collects the sales tax from the consumer as the consumer makes a.

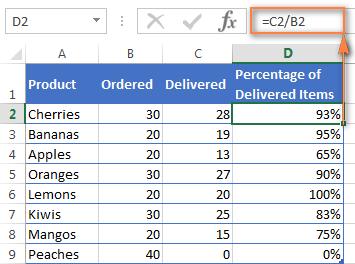

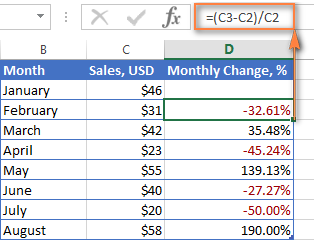

How To Calculate Percentage In Excel Percent Formula Examples

Roth conversion tax calculator 2020 Senin 05 September 2022 Edit.

. By west elm steelcase series 1. But for those of you in the 32 35 or 37 tax bracket a Roth IRA conversion is likely going to end up costing you more tax dollars. But there are a couple of limitations to keep in mind.

Please note that the marginal tax rate for your conversion may be higher than your current marginal tax rate if the. The latter figure includes what the 40000 would turn into if it werent used to pay taxes now. Current marginal income tax rate that will apply to conversion amount.

July 29 2022 No comments. Currently you can save a maximum of 6000 a year or 7000 if youre 50 or older in your Roth IRA. A conversion has advantages and disadvantages that should be carefully considered before a decision is made.

With hindsight maybe that was a good thing. This convert IRA to Roth calculator estimates the change in total net. Makita 18v brushless mixer lxt.

Please enter the following information Current age What age do you plan to retire. Converting to a Roth IRA may ultimately help you save money on income taxes. But if a Roth conversion increases your modified adjusted gross income above a certain amount you could pay much more than that.

This calculator has been updated for the SECURE Act of. Use this free Roth IRA calculator to find out how much your Roth IRA contributions could be worth at retirement calculate your estimated maximum annual contribution and find out what. This calculator estimates the change in total net-worth at retirement if you convert your traditional IRA into a Roth IRA.

Roth IRA Conversion Calculator. The Roth IRA has contribution limits which are 6000 for 2022. A Roth IRA conversion is a tool that allows individuals to convert money from a tax-deferred retirement account like a traditiona.

The break-even tax rate is somewhere. Youll see this hypothetical. If youre age 50 or older you can contribute an additional 1000 as a catch.

What is a Roth IRA Conversion. Without the Roth conversion theyd have only 501000. For instance if you expect your income level to be lower in a particular year but increase again in later years.

What is a Roth IRA Conversion. A Roth IRA conversion is a tool that allows individuals to convert money from a. Meanwhile 200000 in income is only taxable at 24 in 2021 for those married filing jointly.

The conversion alone would result in a 66000 payment to Uncle Sam. The financial fallout from the COVID-19 crisis might create a once-in-a-lifetime opportunity to do Roth conversions at an affordable. Use this fast easy to use and in-depth tax calculator to see the differences between take home income and deductions for a contracting job.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. In 2021 high earners will pay from 208. Details of Roth IRA Contributions.

Best roth conversion calculator.

How To Calculate Percentage In Excel Percent Formula Examples

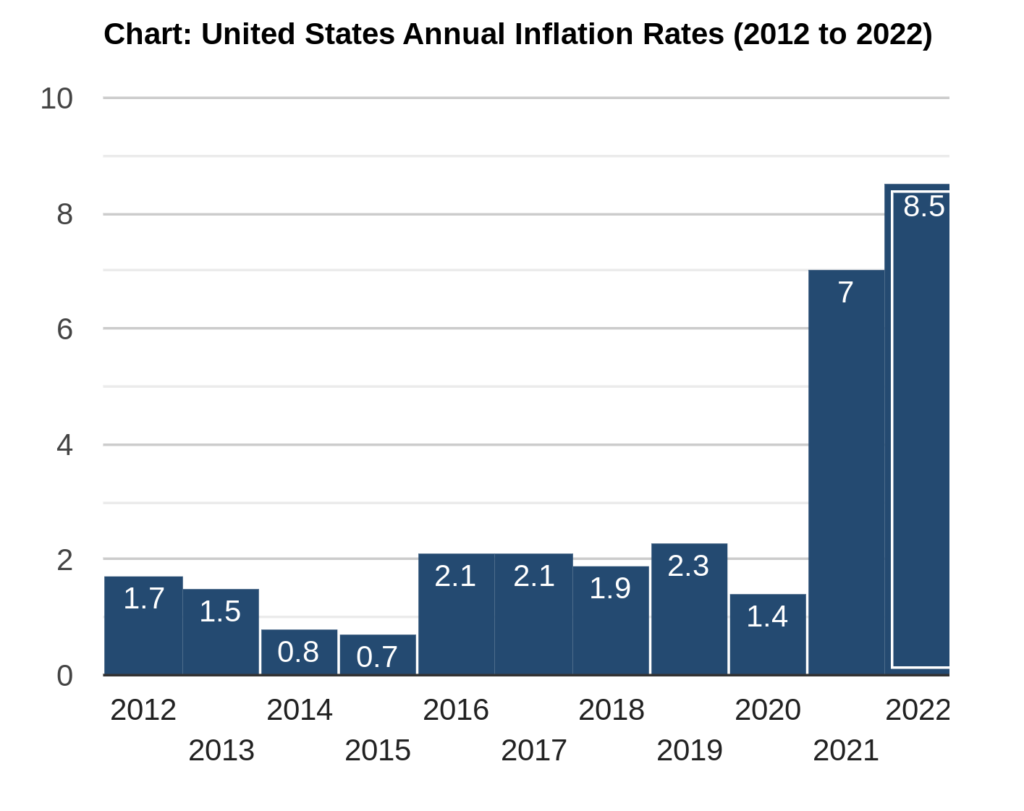

May 2022 National Survey Nearly 4 In 5 Americans Haven T Taken Action To Hedge Against Inflation 14 6 Have Added Real Assets

How To Build An Excel Model For Income Tax Brackets Quora

How Is Long Term Capital Gain Calculated If Bonus Shares Are Issued Quora

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

What Are Roth Ira Accounts Nerdwallet Roth Ira Ira Investment Individual Retirement Account

What Are The Advantages And Drawbacks Of Scrapping The American System Of Tax Brackets In Favor Of A Simple App Based On Logarithmic Or Exponential Formulas That Would Eliminate The Negative Impacts

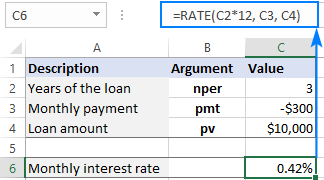

Using Rate Function In Excel To Calculate Interest Rate

Is There A Good Online Calculator That Will Determine The Best Tax Optimized Strategy For Withdrawing Funds From Retirement Accounts During Retirement Quora

Is There A Good Online Calculator That Will Determine The Best Tax Optimized Strategy For Withdrawing Funds From Retirement Accounts During Retirement Quora

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

How To Build An Excel Model For Income Tax Brackets Quora

How To Build An Excel Model For Income Tax Brackets Quora

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

How To Build An Excel Model For Income Tax Brackets Quora

How To Build An Excel Model For Income Tax Brackets Quora